Buying

The Buying tab is the most exciting and perhaps the most work of all! It is certainly the area where I will get to know you the best! As a result, please scan the subdivisions below to see which one offers the best “fit” for where you are right now.

The Buying tab is the most exciting and perhaps the most work of all! It is certainly the area where I will get to know you the best! As a result, please scan the subdivisions below to see which one offers the best “fit” for where you are right now.

I need to figure out how much house I can afford?

I’d like to brush up on the basic mortgage concepts and language I’ll likely encounter.

I need to find out what my credit score is. How can I get a free credit score report?

How might I improve my credit score? (See item # 4 on the link).

I need to get preapproved for a mortgage. Can you recommend some reputable mortgage lenders?

I need to know about the various neighborhoods around Nashville. Can you give a little insight as to what makes each neighborhood special?

I’m ready to discuss with you my “must have”s and my “wishes” for my next house. Let’s talk.

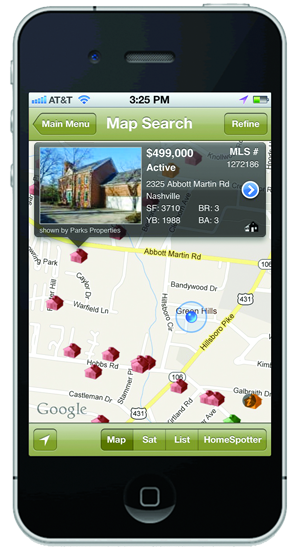

I am ready to preview some houses online.

I recommend you utilize the public site “realtracs.com” (linked above) because it updates more frequently than  the national portals of Zillow.

the national portals of Zillow.

Am I better off RENTING or BUYING? This handy calculator can help you decide.

Plug in your location, and submit numbers that are reasonable — like a $250,000

home — and that you currently pay $1,600 in rent each month, and it will tell you

how many years it takes before buying a home makes more sense than renting.

See the calculator here.

Will you look out for my best interests? What skills set you apart from other agents out there? The answer to these wonderful questions is yes, that’s what a buyer’s representative does. Sharon earned the ABR (Accredited Buyers Representative) designation, an accomplishment that requires additional education and certification. Learn more about why you want an ABR to represent you in this brief video.

Let’s go visit some houses! I’m pre-approved, and I’m ready to put this search into high gear. But I do need a way to compare the properties I visit.

I’ve found the winner (high five!), and I’m ready to make an offer. What do I need to do next? Call Sharon (615-870-4094).

What are today’s interest rates?

I need a little help improving my negotiation skills.

I want to locate a skilled home inspector. Can you recommend some good choices?

What closing costs should I expect?

Here’s some important advice: properties in Middle Tennessee are selling fast. The biggest mistakes I have seen buyers make these days is deciding to 1) Start their search for a home before obtaining a pre-approval letter. It happens too often: you go look at a home, fall in love with it, and then decide it’s time to get pre-approved. Wrong answer; that’s putting the cart before the horse. 2) “Sleep” on a decision and then being told that the house has already gone under contract. Buyers should be ready to act promptly, but not foolishly. 3) Offering too low a price because you grew up convinced you could “haggle.” Your ABR/Realtor(R) will advise you what a reasonable sales price will be. No one wants another buyer to outbid you or for that home to go under contract to somebody else.

Here’s some important advice: properties in Middle Tennessee are selling fast. The biggest mistakes I have seen buyers make these days is deciding to 1) Start their search for a home before obtaining a pre-approval letter. It happens too often: you go look at a home, fall in love with it, and then decide it’s time to get pre-approved. Wrong answer; that’s putting the cart before the horse. 2) “Sleep” on a decision and then being told that the house has already gone under contract. Buyers should be ready to act promptly, but not foolishly. 3) Offering too low a price because you grew up convinced you could “haggle.” Your ABR/Realtor(R) will advise you what a reasonable sales price will be. No one wants another buyer to outbid you or for that home to go under contract to somebody else.

Although it varies with each particular lender, you should allot at least two weeks for your mortgage to be approved, and you should count on closing on your home about six-eight weeks after you submit your loan request.

Finally, if this home will be your first time to own a home and you meet certain income requirements, ask us about the Tennessee Housing Development Agency (THDA) program — which may result in your being able to get a lower interest rate, possibly even assistance with down payments.

The Wilson Group is located at 4100 Hillsboro Circle, Nashville, TN 37215. Our office phone number is 615 436 3031. Sharon: TN License # 325136.